“In the short-run, the market is a voting machine – reflecting a voter-registration test that requires only money, not intelligence or emotional stability – but in the long-run, the market is a weighing machine.”

— Economist Benjamin Graham as quoted in Warren Buffett’s 1993 letter to Berkshire Hathaway shareholders

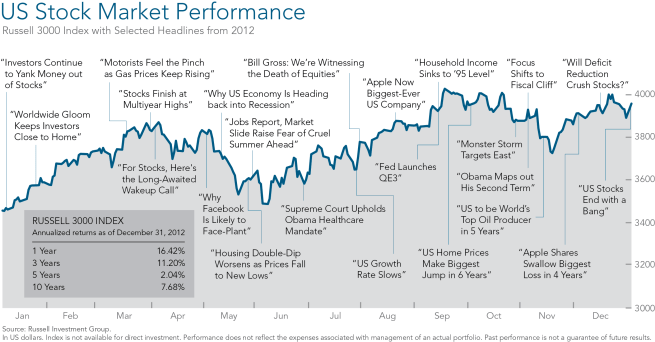

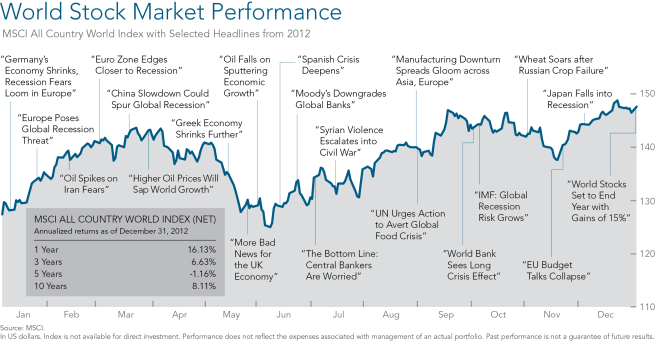

Throughout 2012, there were many compelling temptations to vote with your feet instead of your head. From our budget and fiscal cliff mess to southern Europe going broke and threatening a breakup of the European Union, the world seemed awash in bad economic news.

But instead of declining, US and world markets rose over 16% for the year. Investors who resisted the temptation to abandon their stock holdings were well rewarded for their mettle. What gives?

Ignore the noise.

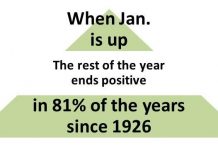

In the short-run, the news can prey on your emotions and investment decisions. Just look at the headlines in the charts below. In highly efficient markets that are computer operated and dominated by caffeine-driven institutional traders, this sort of socioeconomic “news” is typically anticipated and factored into stock prices long before you have the opportunity to trade on the particular event. In other words, by the time you hear the news, it’s no longer “news” to the market, and therefore too late to serve as a reliable guide to your investment decisions. These are the equivalent of the market’s “votes,” according to Graham’s quote above.

For you, as an investor in stocks and stock funds, we recommend focusing on the market’s weighing machine component. There, what matters is the long-term ability of businesses to produce returns over decades. The market weighs those current and prospective returns (including dividends and capital gains), and generally has yielded long-term compensation accordingly. This is explained in Warren Buffett’s 2011 shareholder letter:

“Whether the currency a century from now is based on gold, seashells, shark teeth, or a piece of paper (as today), people will be willing to exchange a couple of minutes of their daily labor for a Coca-Cola or some See’s peanut brittle.”

Create and stick to your plan.

Given the volume of noise pollution out there, the tug of headlines is difficult to resist. That’s where your custom, long-term plan comes in, to help you with your resolve. Again, Warren Buffett provides guidance:

“To invest successfully over a lifetime does not require a stratospheric IQ, unusual business insights, or inside information. What’s needed is a sound intellectual framework for making decisions and the ability to keep emotions from corroding that framework. You must supply the emotional discipline.” — Warren Buffett (Preface to “The Intelligent Investor” by Benjamin Graham)

A written investment plan considering your resources, goals and risk tolerance or need for stability can help stay on a well-chosen path according to your needs and risk tolerances, particularly during times of market turmoil. You need this level of planning, because …

No one knows the future.

Obviously, the weight of future dividends and capital gains is not certain. There’s the expectation, but no seal of guarantee that your steadfast participation in the markets will perform as anticipated. You need to be compensated for that uncertainty or risk. The good news is that historically, over long periods, stocks have provided compensation. But “past performance is not indicative of future results” so diversifying globally to reduce the risk of long periods of declines or worse makes sense as outlined in my previous post.

Still, diversification does not spare you during those times when the market becomes an irrational voting machine in a depressive phase. Rather than trying to anticipate day-to-day, month-to-month ups and downs of the market consider these strategies:

-

When your Investment Plan is on track according to your unique needs, sit back and earn the market return.

Avoid trying to time the market or chase individual stocks based on short-term fear or exuberance; when and if necessary, adjust to maintain your allocation weights. To echo Warren Buffett:

“Over the 35 years, American business has delivered terrific results. It should therefore have been easy for investors to earn juicy returns: All they had to do was piggyback Corporate America in a diversified, low-expense way.” — 2004 Berkshire Hathaway Annual Report

-

If your Investment Plan calls for disciplined portfolio adjustments, make those adjustments as patiently as possible, on the basis of sensible valuations.

While businesses may have bright prospects for paying future dividends, in a manic phase you may pay too high a price for the investment. Capital gains will not only fail to materialize but could prove to be losses. The path to determining whether an investment is over- or undervalued is cloudy even for an entire asset class. But Buffett again provides guidance on how to evaluate market valuations, taken from his 2004 letter to shareholders:

“Investors should remember that excitement and expenses are their enemies. And if they insist on trying to time their participation in equities, they should try to be fearful when others are greedy and greedy only when others are fearful.”

If you’re unable to reach Buffett directly for additional wisdom and you would like to discuss your investment approach with a professional advisor at Granite Hill Capital, we would welcome your call or e-mail.

These statements are based on assumptions that may involve known and unknown risks and uncertainties. Past performance is not indicative of future results and no representation is made that the stated results will be replicated. Indexes are not available for direct investment but reveal positive and negative performance over time. Their performance does not reflect the expenses associated with the management of an actual portfolio. Diversification does not ensure a profit or protect against a loss in a declining market.

Copyright © 2012, Granite Hill Capital Management, LLC.

This blog entry is distributed for educational purposes and should not be considered investment, financial, or tax advice. Investment decisions should be based on your personal financial situation. Statements of future expectations, estimates or projections, and other forward-looking statements are based on available information believed to be reliable, but the accuracy of such information cannot be guaranteed. These statements are based on assumptions that may involve known and unknown risks and uncertainties. Past performance is not indicative of future results and no representation is made that any stated results will be replicated. Indexes are not available for direct investment. Their performance does not reflect the expenses associated with the management of an actual portfolio.

Links to third-party websites are provided as a convenience and do not imply an affiliation, endorsement, approval, verification or monitoring by Granite Hill Capital Management, LLC of any information contained therein. The terms, conditions and privacy policy of linked third-party sites may differ from those of this website.