Stability, in life and in investing, is a good thing. It reduces your mental anguish by insulating your portfolio from sharp declines. It can also help you produce a fatter portfolio by the time you retire.

“I tell people Investing should be dull. It shouldn’t be exciting. Investing should be more like watching paint dry or watching grass grow. If you want excitement, take $800 and go to Las Vegas.” — The late Paul Samuelson, Nobel Prize winning economist

Professor Samuelson spoke these words in September 1999 at the height of the stock market bubble. They still ring true, particularly in today’s cautious environment, which may have you craving more stable investment returns. Let me explain why that craving may be worth satiating – and how.

Volatility is a drag on wealth:

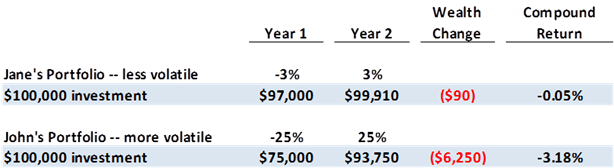

After a loss, your portfolio must gain even more in percentage terms to fully recover. For example, if your portfolio loses 3% in one year, it will need to gain 3.1% in the next year for you to break even. Larger percentage losses require even larger percentage gains for full recovery. A 25% loss requires a break-even gain of 33.3%. Such extreme ups and downs, repeated over time, is what I mean by the drag of volatility.

The impact of volatility is illustrated below. Both Jane’s and John’s portfolios start at $100,000. They each experience percentage losses in Year 1 that are exactly offset by percentage gains in Year 2. However, in dollar terms, John’s portfolio ends $6,250 lower than Jane’s portfolio. See what I mean? More volatile portfolios have lower compounded returns.

Diversification can smooth returns:

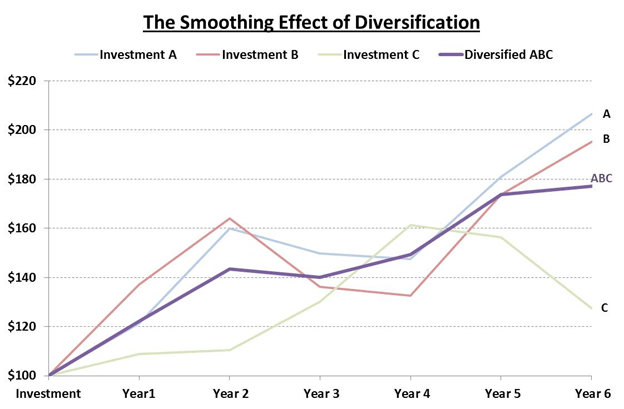

Diversification is achieved by combining investments that tend to zig when others zag. It requires you to focus on the performance of your total portfolio, not just the individual investments. By design, a diversified portfolio tends to be neither the best nor the worst performer in any given year. The intent is to foster stability.

You can see the impact of diversification in the graph below. Investments A, B, and C perform as Diversified Portfolio ABC, represented by the darkest, purple line. The purple line moves more gently than the individual investments. It has more stable performance.

Investments reflect the performance of Russell 2000 Value Index (Investment A), Dow Jones US Select REIT Index (Investment B), and MSCI EAFE Value Index (Investment C) for 1996 – 2001. Diversified ABC is a portfolio equally weighted with each investment and rebalanced annually to restore the target weights.

This graph may also have you wondering:

Why not invest all your money in Investment A since it does best? First, that bet would require knowledge of the future, which no one knows for certain. Imagine, for example, if you looked at this same chart in Year 4 when Investment C was the winner and made your selection then? Whoops.

But more importantly, trying to “pick the winner” (or avoid the loser) is the wrong game to begin with. As explained above, it is better to consider the interplay among your investments rather than the individual movements, spread your bets, and aim for a dull portfolio with smoother expected performance. Such a portfolio is designed to insulate you from volatility when it strikes again and put you on a more secure path to retirement.

Read More about Investment.

These statements are based on assumptions that may involve known and unknown risks and uncertainties. Past performance is not indicative of future results and no representation is made that the stated results will be replicated. Indexes are not available for direct investment but reveal positive and negative performance over time. Their performance does not reflect the expenses associated with the management of an actual portfolio. Diversification does not ensure a profit or protect against a loss in a declining market.

Copyright © 2012, Granite Hill Capital Management, LLC.

This blog entry is distributed for educational purposes and should not be considered investment, financial, or tax advice. Investment decisions should be based on your personal financial situation. Statements of future expectations, estimates or projections, and other forward-looking statements are based on available information believed to be reliable, but the accuracy of such information cannot be guaranteed. These statements are based on assumptions that may involve known and unknown risks and uncertainties. Past performance is not indicative of future results and no representation is made that any stated results will be replicated. Indexes are not available for direct investment. Their performance does not reflect the expenses associated with the management of an actual portfolio.

Links to third-party websites are provided as a convenience and do not imply an affiliation, endorsement, approval, verification or monitoring by Granite Hill Capital Management, LLC of any information contained therein. The terms, conditions and privacy policy of linked third-party sites may differ from those of this website.