“You want to diversify. But how? Harry Markowitz won a Nobel Prize in economics for solving this problem. But when Markowitz made his own investments for his retirement, he did not use his Nobel Prize-winning method. Instead, he employed a simple rule of thumb called 1/N: Allocate your money equally to each of N funds.” – Risk Savvy: How to Make Good Decisions, Gerd Gigerenzer

Risk Savvy argues that allocating your money equally among funds is superior to relying on sophisticated models. After all, the future is unknown and the forecasting accuracy of financial experts is miserable. In contrast, Markowitz’s Modern Portfolio Theory not only requires estimates of expected performance for individual investments but how these investments perform in total. Gigerenzer points to research showing that equally allocated investments perform better than allocations based on Modern Portfolio Theory.

Rather than debate the strengths and weakness of equal weight research and Modern Portfolio Theory, let’s examine the implications of equal weights for funds in your retirement accounts.

You lose control of risk and expected return by using equal weights.

To be clear, using equal allocations, or “1/N,” means if you have 5 funds to choose from in your 401(k) or 403(b), you allocate 1/5, or 20%, to each. For example, if your retirement plan has five choices and four are stock funds, 1/N will result in an 80% stock and 20% bond allocation. The choices could be reversed where four of the five choices are bond funds and only one is a stock fund resulting in an 80% bond and 20% stock allocation. With this rule of thumb your plan administrator determines your fundamental stock-bond decision, not you.

The implications of equal weights, a historical perspective.

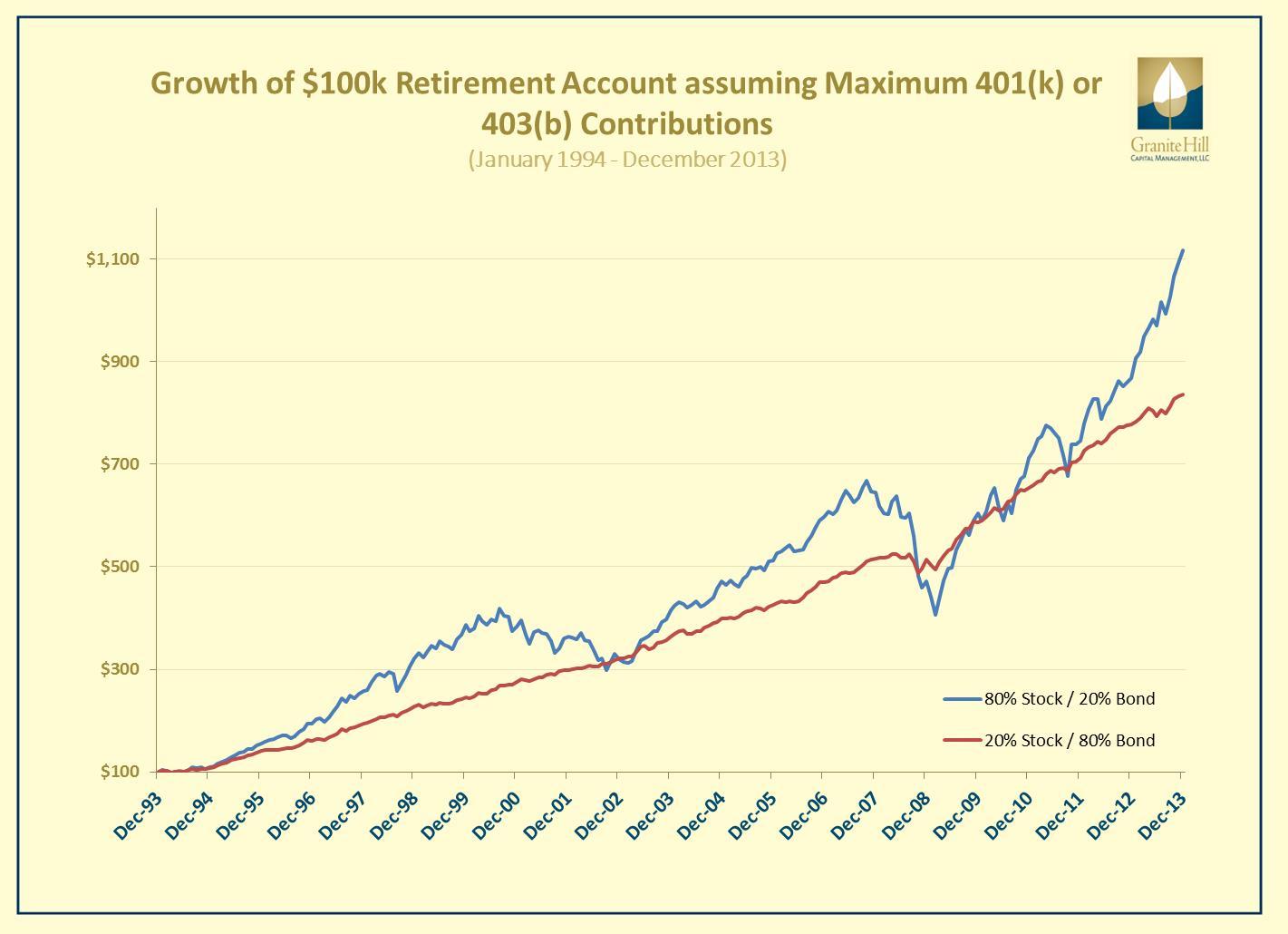

To illustrate the performance implications of equal weighting based on the offerings from the 5 fund plan example from above, we show the performance of both allocations over the past twenty years. Of course, the performance of individual funds will differ from the index based performance used, but these broad brush portfolios illustrate the principle.

Monthly contributions are made consistent with the annual limits ranging from $9,240 in 1994 to $17,500 in 2013. Stock / bond portfolios are rebalanced annually. Granite Hill Capital calculations. Stocks reflect performance of the Russell 3000, a US stock index representing 98% of the US stock market, and bonds reflect the performance the Barclay’s Aggregate Bond index, a broad index of the taxable U.S. bond market. Source: Morningstar. Indexes do not have expenses of a mutual fund.

Over the 20 year period ending in December 2013 the 80% stock / 20% bond portfolio accumulated $275,000 more than the portfolio dominated by bonds. Again, these results are entirely determined by the investment offerings in your retirement plan when equal allocations are applied.

What matters is that you decide.

An 80% allocation to stocks dictated by equal weighting may be appropriate if you are early in your career, with a long-term outlook and a stomach for 25% to 50% declines in account value as the chart above shows. Indeed, three of the largest target date fund families start at nearly 90% stocks 20 years away from retirement as illustrated in Buffett’s Bequest: Risky Asset Allocation for Retirement. But if you are in retirement, and withdrawing from this account for significant living expenses, you risk a more rapid depletion of the account from a bad sequence of returns when stocks dominate.

Markowitz does not endorse equal weights.

Circling back to Gigenzer’s contention that Markowitz chose equal weights early in his career for simplicity, he seems to miss the intention. Markowitz was avoiding the regret at having most of his money invested in the losing investment, not because he intended to use the simple equal allocation method. In any case, there is no doubt that Markowitz now takes a more nuanced approach that weights investments according to their risk and return attributes consistent with Modern Portfolio theory. He also adds practicality by setting an income floor with bonds.

Like most people, I split 50/50 (referring to his original allocation noted above). Now I don’t do that. I split my money among asset classes, like efficient portfolios I have seen. I know I should overweight small-cap stocks as compared with large-caps and perhaps overweight emerging markets as compared with more established international markets. We do invest in a large number of municipal bonds, which provide enough money so that we can just live. I tell myself if worse comes to worst, we can live.” – Harry Markowitz, Ideas and Innovation across Multiple Disciplines

This blog entry is distributed for educational purposes and should not be considered investment, financial, or tax advice. Investment decisions should be based on your personal financial situation. Statements of future expectations, estimates or projections, and other forward-looking statements are based on available information believed to be reliable, but the accuracy of such information cannot be guaranteed. These statements are based on assumptions that may involve known and unknown risks and uncertainties. Past performance is not indicative of future results and no representation is made that the stated results will be replicated. Indexes are not available for direct investment. Their performance does not reflect the expenses associated with the management of an actual portfolio. Copyright © 2016, Granite Hill Capital Management, LLC.

Links to third-party websites are provided as a convenience and do not imply an affiliation, endorsement, approval, verification or monitoring by Granite Hill Capital Management, LLC of any information contained therein. The terms, conditions and privacy policy of linked third-party sites may differ from those of this website.

“This blog entry is distributed for educational purposes and should not be considered investment, financial, or tax advice. Investment decisions.”

This blog entry is distributed for educational purposes and should not be considered investment, financial, or tax advice. Investment decisions should be based on your personal financial situation. Statements of future expectations, estimates or projections, and other forward-looking statements are based on available information believed to be reliable, but the accuracy of such information cannot be guaranteed. These statements are based on assumptions that may involve known and unknown risks and uncertainties. Past performance is not indicative of future results and no representation is made that any stated results will be replicated. Indexes are not available for direct investment. Their performance does not reflect the expenses associated with the management of an actual portfolio.

Links to third-party websites are provided as a convenience and do not imply an affiliation, endorsement, approval, verification or monitoring by Granite Hill Capital Management, LLC of any information contained therein. The terms, conditions and privacy policy of linked third-party sites may differ from those of this website.